For some, a new FORTIFIED Roof installation may be out of their budget. For others, a new FORTIFIED Roof may not be a practical investment for numerous reasons discussed in other blogs, such as cost, recent roof replacement, or existing solar. However, a FORTIFIED Roof Insurance Endorsement may be an option at some point in the near future.

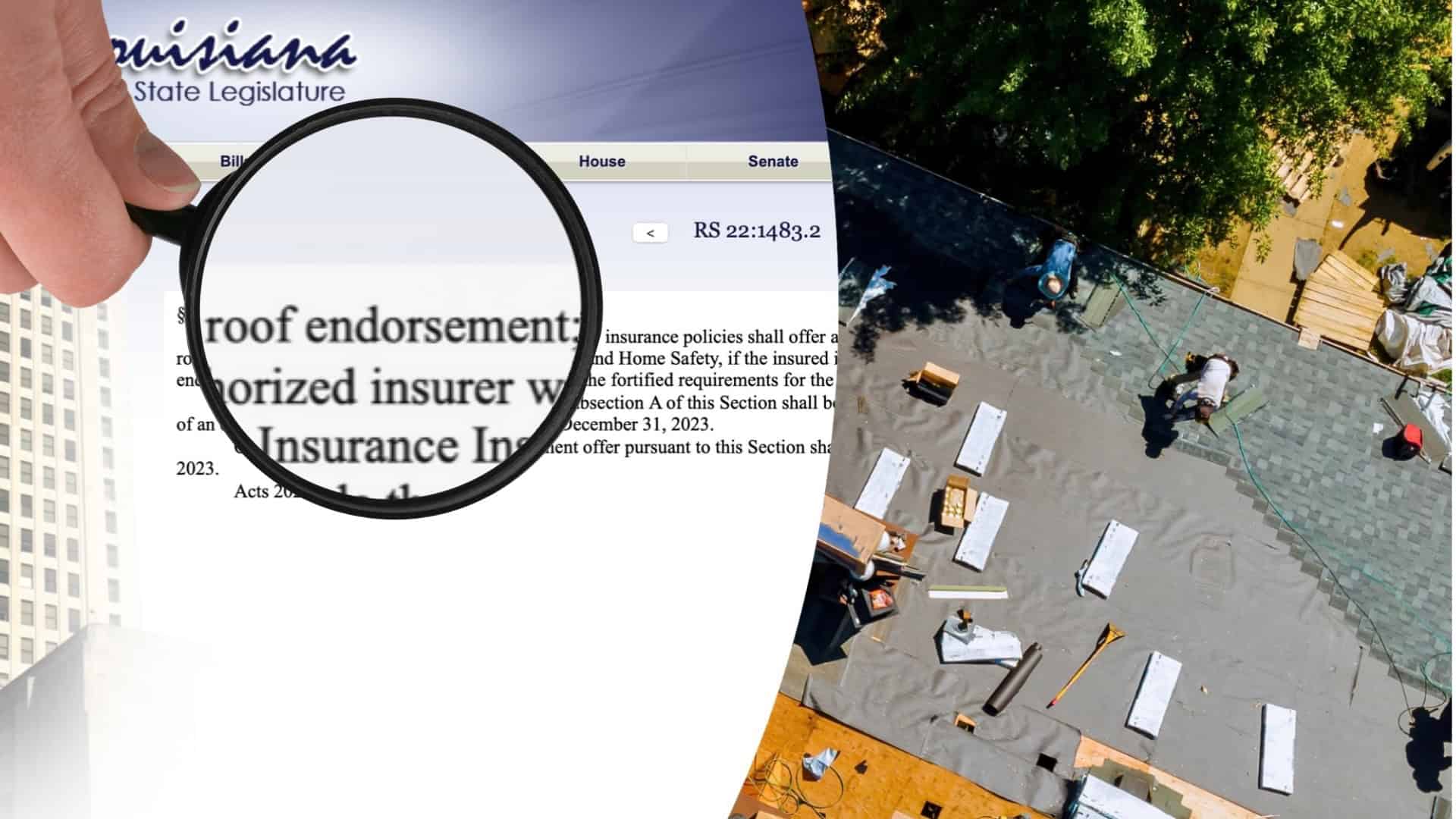

Regardless of why one may decide not to install a FORTIFIED Roof in the foreseeable future, your homeowner’s insurance may be a viable solution to having one installed sooner than you initially believed. Louisiana State Law §1483.2 explicitly mandates that Louisiana insurance companies offer a FORTIFIED Roof Endorsement when renewing your policy. What this means for policyholders is that by voluntarily accepting this endorsement, you’re guaranteed to receive a FORTIFIED Roof replacement if your roof requires replacement upon a covered disaster. Learn More

§1483.2. Fortified roof endorsement; mandatory offer

A. Any authorized insurer writing homeowners’ insurance policies shall offer an endorsement to upgrade an insured’s non-FORTIFIED home to comply with the fortified roof standards of the Insurance Institute for Business and Home Safety, if the insured incurs damage covered by the policy that requires the roof to be replaced. The endorsement shall upgrade the home consistent with the fortified requirements for the geographic area in which the home is located.

B. The endorsement offer provided for in Subsection A of this Section shall be made at the time of writing a new policy on a non-FORTIFIED home and upon first renewal of an existing policy on a non-FORTIFIED home after December 31, 2023.

C. Insurers required to make an endorsement offer pursuant to this Section shall file endorsement forms and accompanying rates with the department by October 1, 2023.

Acts 2023, No. 12, §1.

The Next Storm Season Is Always Approaching

Ask your insurance agent or carrier about this mandated endorsement, as it may be particularly beneficial for homeowners who cannot upgrade to a FORTIFIED Roof before the next storm season. If, however, the unfortunate happens, this endorsement will provide the additional funds required to install a new FORTIFIED Roof rather than only a new roof, as is regularly the case if the roof needs replacement due to a covered loss.

The extra benefit of this endorsement is that if your roof is significantly affected by a covered event, your insurance company must give you the FORTIFIED insurance premium discount we’re all familiar with according to this same state law since your insurance carrier afforded you the expense for your newly installed FORTIFIED Roof. It’s somewhat of a two birds with one endorsement!

Look into the §1483.2 Fortified roof endorsement. It may be worth the peace of mind knowing that should such a tragic event occur; you are assured that your new insurance-funded FORTIFIED Roof will lower your insurance premiums for coming years while providing all the proven benefits of your new strengthened roof.

What You Should Know

This law (Louisiana Revised Statutes 22:1483.2) requires:

Mandatory Offering: Insurance companies that write homeowners insurance policies in Louisiana must offer a FORTIFIED Roof endorsement to policyholders at each renewal.

What the Endorsement Covers: The endorsement must cover the increased cost of repairing or replacing a roof to meet the FORTIFIED Home™ standards following a covered loss.

Applies to Renewals: This requirement applies specifically when your policy is being renewed, not just for new policies.

Consumer Choice: While insurers must offer this endorsement, you, as the policyholder, can accept or decline it.

If your insurance company has not offered you this endorsement at renewal, they may be out of compliance with Louisiana law §1483.2. You can reference this specific statute when contacting your insurance company to request the FORTIFIED roof endorsement, which they are legally required to offer you at renewal.

This law represents Louisiana’s efforts to promote resilient construction by ensuring homeowners can rebuild to higher standards after a loss.

The Spray Foam Adhesive Alternative. Diversified Energy To The Rescue.

Don’t want to wait till the next Hurricane Season to see if the Endorsement works out to your favor? Want the FORTIFIED Roof now? You may possibly not need to wait for a new roof. Nor pay for a new roof.

Approved by the Insurance Institute for Business and Home Safety (IBHS), if eligible, Diversified Energy can employ the Supplemental Deck Attachment alternative to meet the same FORTIFIED Roof certification but without having to suffer through the annoyance and exorbitant cost of replacing your entire roof.

The IBHS 2020 FORTIFIED Home™ Standard manual, pages 20 through 22, lists the eligibility for sealing and strengthening the roof deck with the Supplemental Deck Attachment alternative.

The existing roof cover does not show visible signs of damage or deterioration. *

There is only one layer of roof covering.

Existing roof covering is estimated to have at least 5 years of useful life remaining. *

There is adequate access to the attic to allow application of adhesives along joints, between sheathing and roof framing members as well as along all seams between the roof sheathing panels. (i.e. complete 100% access to all roof rafters) **

Drip edge is installed. 2020 FORTIFIED Home™ Standard F-SRD-1 https://fortifiedhome.org/wp-content/uploads/F-DE-3.pdf

Note: Consult a Certified FORTIFIED Evaluator to determine if the existing roof qualifies per Section 3 Designation Requirements.

Qualification is determined by your Certified FORTIFIED Evaluator. Although these criteria are per FORTIFIED guidelines, some Evaluators may limit the roof up to 10 years of age.

** Diversified Energy defines accessibility as the ability to access 100% of existing roof rafters. Cathedral ceilings, vaulted ceilings, dormer windows, and other similar structural characteristics, prohibiting access to any portion of roof rafters disqualify the existing roof from Section 3 Designation Requirements alternative if no access is provided to the existing hidden rafters between sheetrock and roofline.

But Wait, There’s More – The Louisiana Storm Mitigation Incentives Program.

A Windstorm Mitigation Survey is a specialized home inspection that assesses a structure’s ability to withstand damage from high winds, such as those experienced during hurricanes, tornadoes, and other severe windstorms.

Though there are many similarities to the IBHS FORTIFED Roof program, the Louisiana Storm Mitigation Incentives Program came about post Hurricane Katrina from a 2007 Legislative Session requiring insurance carriers in Louisiana to provide premium discounts for properties’ compliance with the building code and for installation of mitigation measures that reduce wind-related losses.

The Wind Mitigation survey form is used by a licensed Windstorm Surveyor to confirm what resilience features the home may already have and what other improvements can be made to increase the overall resilience of the Home.

Below are Louisiana incentives encouraging wind mitigation improvements:

Insurance premium discounts for building or updating a home to comply with the Louisiana State Uniform Construction Code and for installing mitigation improvements that are proven to reduce windstorm or hurricane damage.

Insurance premium discounts for building or updating a home to comply with the Insurance Institute for Business and Home Safety (IBHS) FORTIFIED standards.

Tax deductions for voluntarily updating a home to bring it into compliance with the new building code.

State sales and use tax exclusions on storm shutter devices for storm and hurricane protection.

For additional information concerning Louisiana Wind Mitigation Incentives, go to: LDI Storm Mitigation Incentives & GNO Inc Insurance Discount Guide

Whether your interest is in the FORTIFIED Roof Certification, [Insurance Discount Guide] applying for the Louisiana Fortify Homes Grant, or utilizing the Residential Storm Mitigation Incentives, call Diversified Energy to see if you’re eligible for the spray foam Supplemental Deck Attachment alternative and save substantially on achieving approval for all three incentives.